2024 TRANSPARENCY REPORT

We are chocolate pioneers.

Taza makes stone ground chocolate that is seriously good and fair for all. From farm to factory, we do things differently.

We do things transparently.

It starts with Taza Direct Trade. We said no to opaque supply chains and low-quality cacao. We created the chocolate industry's first third-party certified Direct Trade cacao sourcing program, to ensure quality and transparency for all. We have real, face-to-face relationships with partners who respect the environment and fair labor practices. They provide us with the best organic cacao, and we pay them prices significantly higher than Fair Trade. In fact, you can see exactly what we pay them, right here in our 2024 Annual Cacao Sourcing Transparency Report.

Taza Direct Trade means more money for our partners, the best cacao for us, and seriously good chocolate for you.

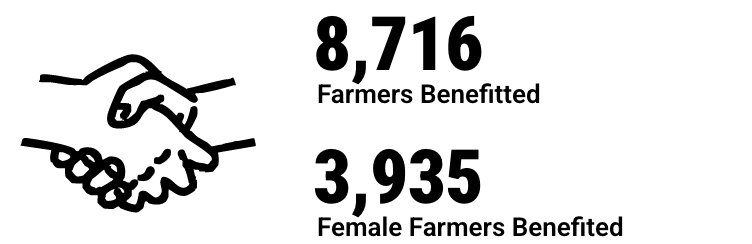

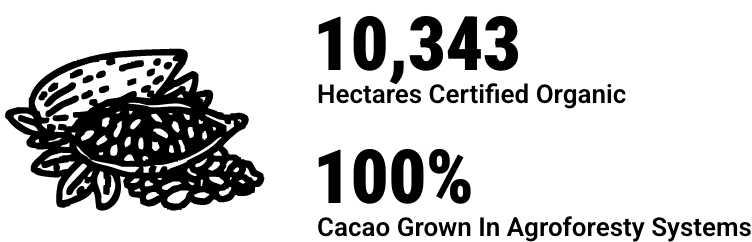

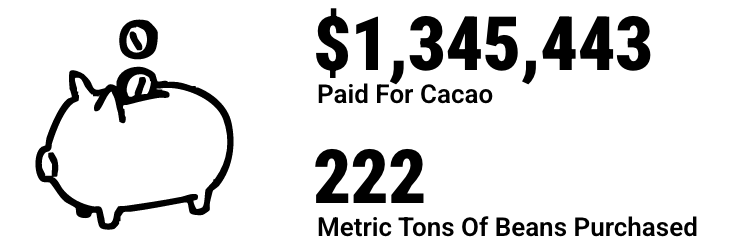

OUR 2024 KEY DIRECT TRADE INDICATORS

REAL RELATIONSHIPS

To us, cacao is not just a commodity. We know our producers personally. Our goal is to meet with them in person or via video conference at least once every year.

THE BEST CACAO

We only purchase Certified USDA Organic cacao that meets our high quality standards and is approved by the Taza Tasting Panel for its seriously good flavor.

MORE MONEY FOR PARTNERS

We pay at least $500 above the market price-a 15-20% premium-and never less than $2,800 per metric ton for cacao.

THIRD PARTY CERTIFICATION

We’re serious about transparency and trust. To guarantee the integrity of our Direct Trade program, our Direct Trade claims are independently verified each year by Baystate Organic Certifiers, a USDA-accredited organic certifier based in Massachusetts.

YEAR IN REVIEW

By Alex Whitmore, Taza Chocolate Co-Founder and CEO | November 2024

Adriano Rodriguez of Oko-Caribe, Alex Whitmore of Taza Chocolate, Gualberto Acebey of Oko-Caribe, Gilbert Gonzales of PISA Haiti.

Friends,

Since we last published our Transparency Report in late 2023 a sea change has occurred in the cacao industry. Prices then were considered high at $4,000 per metric ton. Today as I write this, cacao is trading over $7,000 per metric ton! In the months between there were dramatic daily price swings and great difficulty settling trades as fixation timing could move by hundred of dollars a ton in a matter of minutes.

Almost all of this increase in price can be attributed to classic supply and demand dynamics. Production shortfalls due to a variety of factors including underinvestment, weather patterns, disease, and extended periods of low prices combined with increased demand generated a perfect storm for the cocoa market. Price swings have been exacerbated by momentum traders and other even more modern trading strategies, which hasn’t helped us physical buyers very much.

This price increase is a boon for cacao farmers, despite being one of the smaller crop years in a long time. It has also changed the way the chocolate candy industry thinks about everything from formulation to packaging, and obviously pricing. For Taza it was a crisis of ensuring cacao supply for our factory. We purchased organic beans from a Dominican processor Roig Agro-Cacao for the first time ever just to ensure we could keep the mills turning in the beginning half of the year. Roig is an aggregator/processor in San Francisco de Macoris, very near Oko Caribe, another partner of ours in the region. However, this particular cacao had been imported years earlier during a very different market, and we were able to purchase it from our import partner, Atlantic Cocoa, as a stop-gap measure.

The price premium to secure physical cacao for processing was well over $2,000 above the cocoa commodity trading price at times and still remains very high. Large processors had to pay out these large premiums just to get access to supply, and competition to get cocoa was stiff.

Because of our long-time relationships and partnerships with the highest quality producers, we were able to weather much of the storm and obtain the organic, quality cacao that we need to continue production.

Finca Elvesia, a 200+ hectare organic cacao farm in the Dominican Republic that we have been partnering with since 2010, was heavily impacted by Hurricane Fiona back in 2022. It took two years for the crop to come back in and it is still well below normal production levels. This year we were able to buy only 25 tons of cacao from them. The team at Finca Elvesia are cautiously optimistic that the crop will return to former output levels in 2025.

Oko Caribe, a processor of cacao beans in the central region of the Dominican Republic who we have been buying from since 2013, experienced high levels of competitiveness buying at the farm gate with other processor-exporters that operate in the region. The farm gate price was often close to the world market price which some days exceeded US$10,000/MT. This led to a challenge finding buyers at a profitable level for the company. We normally will contract for many containers of cocoa from this processor, however we only were able to contract for two containers during the 2024 main crop period due to lack of available volume.

PISA, our export partner in Haiti since 2015, continues to struggle with basic infrastructure in the country which makes bean buying and exporting difficult. Added to that, cocoa buyers from the Dominican Republic have been smuggling cocoa over the border from Haiti to fill undersupplied contracts with buyers, driving up the farm gate price for PISA and reducing availability and overall volumes. Despite these challenges, Taza was able to secure over 50 metric tons during the 2024 main crop period.

ABOCFA, a cooperative of organic producers in Ghana where we have been sourcing cacao since 2018, has been growing output steadily. However this year they expect to have a smaller crop due to black pod fungus caused by heavy rains. Additionally, challenges within Cocobod, the government-run cacao export marketing agency who controls farm-gate pricing, as well as smuggling of production into Côte d'Ivoire, have reduced the country’s ability to effectively grow exports. This has had a negative impact on export volumes. We were unable to secure any cocoa from them directly but purchased excess volume from another partner importer of ours, Uncommon Cacao.

Due to challenges in Ghana, we endeavored to secure African cacao from Uganda by working with a company called Latitude Trading based in Kampala and operating in the Semuliki Forest in the Western side of the country near the border with the Democratic Republic of Congo. We purchased a trial amount of 25 metric tons to begin experimenting with this new origin. We are excited by the results of this production and are looking forward to continuing working with this new partner.

For Taza and other specialty chocolate makers like us, all of this market disruption means that we will be paying significantly higher prices for our key ingredient, and that chocolate price inflation will continue. Eventually, prices will moderate, as more plantings and higher profit potential in the sector drive investment. In the meantime, cacao farmers can earn more for what harvest they are able to collect, a mission we have been pursuing at Taza since 2005.

I encourage checking out our Partner Reports, linked below, to view our prices paid and volumes purchased from each of our producer partners, and also buying some of our delicious Taza Direct Trade Cacao chocolate products!

Yours in transparency,